Thanks for joining us for the first episode of The T.I.M.E Blueprint with Frank Oliver of Oliver Asset Management. We’re excited to have you and look forward to the financial planning and retirement conversations we’ll have every show.

To get things kicked off, we wanted to take a little time telling you more about who we are and provide some background on Oliver Asset Management. We’ve been around the Colorado area all of our life, so we’ll tell you why it’s special to us and what you might find us doing away from the office.

Plus, we’ll give you a preview of what we hope you’ll learn from each show and who will get the most out of the conversations we have with Frank. Please subscribe to the show if you like what you hear and stay tuned for more from The T.I.M.E Blueprint.

Here are some of the highlights from this episode:

0:00 – Intro

1:05 – Frank’s background

3:00 – How the business has evolved

4:13 – What being a financial advisor means

9:00 – What we like most about Colorado

12:33 – Frank’s passion for flying

13:39 – What we hope you learn from the show

16:03 – Frank’s favorite TV show growing up

Subscribe & follow the show for free on your favorite apps:

Helpful Resources:

Learn more about the T.I.M.E. planning process by clicking here.

You can also schedule a free planning session with Frank Oliver and the team by clicking here.

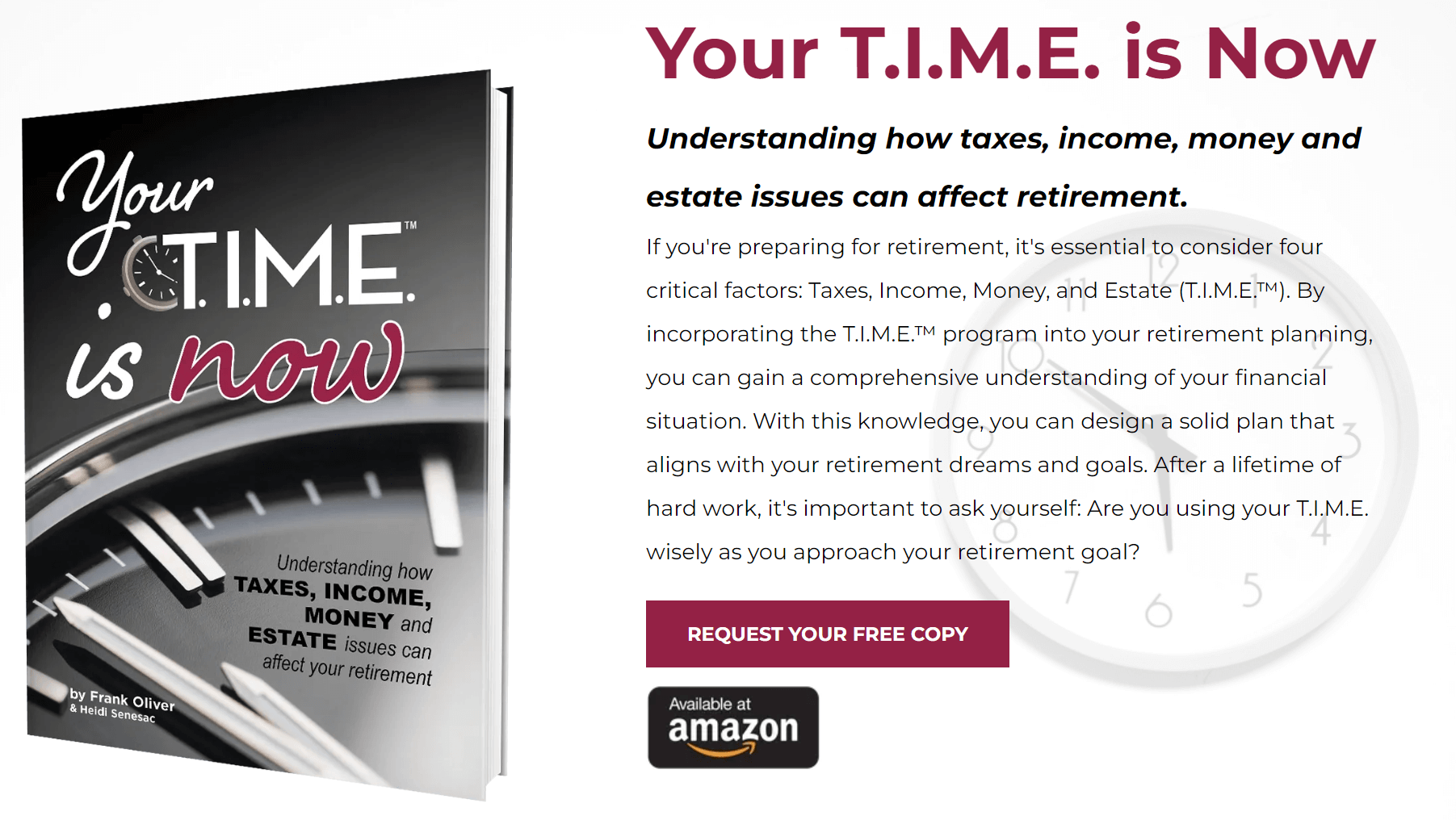

Get your copy of Frank's book!