It’s the beginning of a new year – a time when many of us make resolutions to improve our lives. But how often do we resolve to improve the way we feel about our finances? Today, we’re talking about spending with confidence, a surprising challenge for many retirees.

Having spent your entire career being encouraged to save diligently for retirement, transitioning to a mindset of spending during retirement can be surprisingly difficult. In this episode, Frank tackles this issue and discusses the guilt that many retirees feel when using their hard-earned savings. He also shares three practical tips that you can easily apply to bolster your confidence in making sound financial choices in this new phase of life.

Here’s some of what we discuss in this episode:

0:00 – Intro

1:29 – The struggle to spend in retirement

4:43 – The guilt element

6:45 – Tangible tips to consider

Subscribe & follow the show for free on your favorite apps:

Helpful Resources:

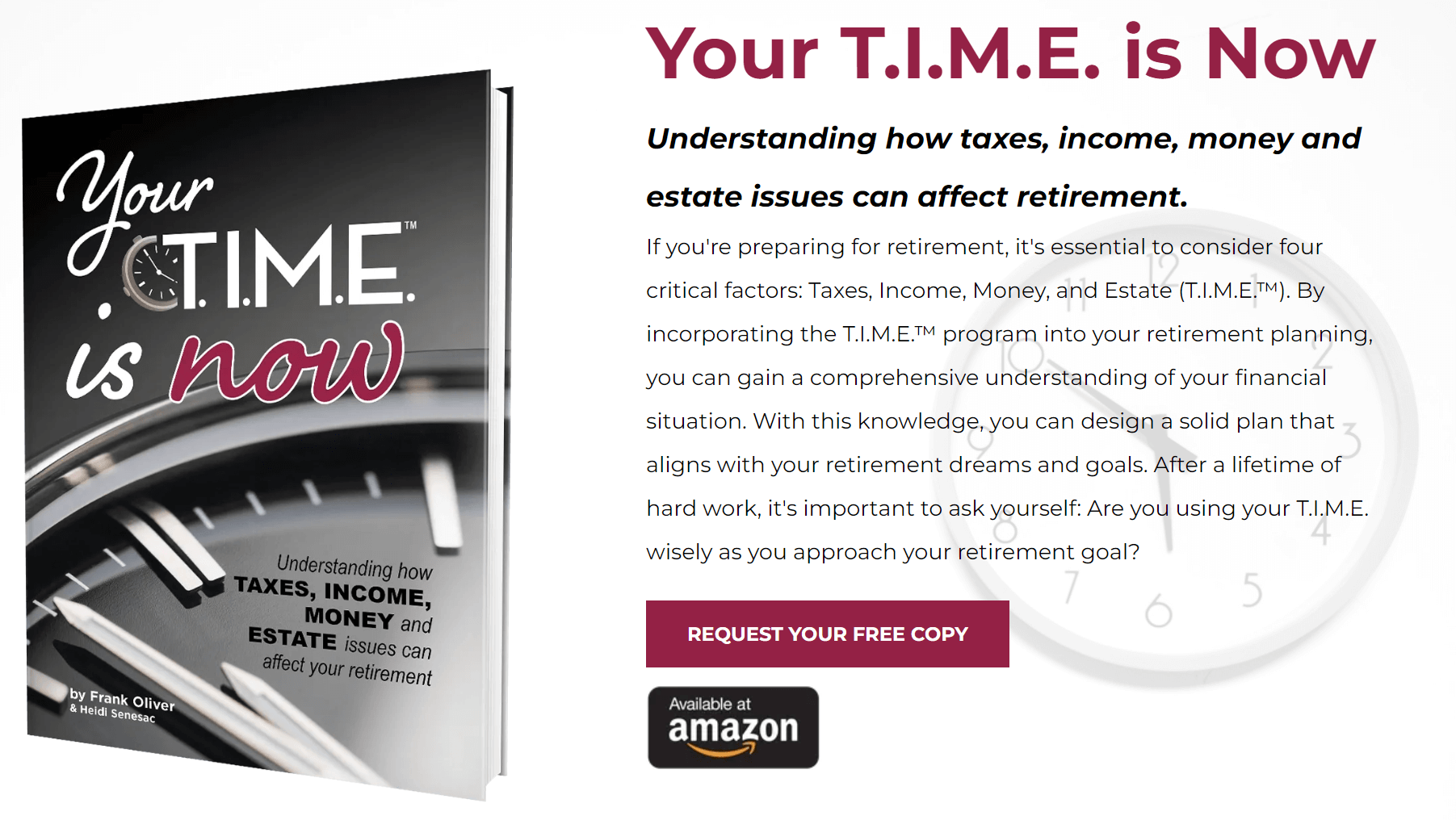

Learn more about the T.I.M.E. planning process by clicking here.

You can also schedule a free planning session with Frank Oliver and the team by clicking here.

Get your copy of Frank's book!